AI HELOCs: How to Get Approved in 24 Hours

Unlike traditional mortgage loan approvals, the modern lending technology has ensured that the approval for a Home Equity Line of Credit is no longer prolonged. AI-powered HELOCs are designed to remove delays, reduce confusion, and skip heavy-paperwork. Today, artificial intelligence is helping lenders serve homeowners better by providing faster access to their home equity. What once took days or weeks to approve now happens in a matter of 24 hours! This article explains exactly how AI HELOC approval works and how it gets approved within 24 hours. This is not an industry theory; it is just a modern-day lending process. What Makes AI HELOC Approval So Fast Traditional HELOC applications often involve extensive paperwork, manual reviews, and lengthy waiting periods. AI home equity loan platforms change this completely by automating most of the approval process. Instead of waiting for one step to finish before the next begins, AI systems evaluate multiple factors, such as your financial situation, property value, and creditworthiness, simultaneously in minutes. This is what allows approvals to move quickly. The AI system instantly accesses your credit report, verifies your income, and evaluates your property’s current market value using real-time data. This means no more waiting weeks for appraisals or manual document reviews. The technology can process information that would take humans hours to analyze in just seconds. AI HELOC approval systems also reduce human error. When people manually review applications, mistakes can happen, leading to delays or incorrect decisions. AI removes this risk by consistently applying the same criteria to every application, ensuring fair and accurate evaluations every time. Now let’s walk through the process. How the 24-Hour AI HELOC Approval Process Works Step 1: Online Application This process hardly takes 10-15 minutes to complete. Submit a simple online application with the following details: Personal information Property details Estimated home value Existing mortgages Credit and income information This step requires no physical paperwork, and the upload is quite easy. Most information is uploaded into the server using AI systems or digital tools. Once submitted, the system immediately moves to evaluation. Step 2: Identity and Ownership Verification The verification process is instantaneous. As soon as the application is submitted, AI systems verify your identity, the details regarding the ownership of your property, and records that exist in public databases automatically. This step literally has no waiting period. If everything is good to go, your application moves forward instantly. Step 3: AI Property Value Check There is no in-person property value check involved here. AI HELOCs use automated valuation models to analyze: Geography of your property The sales market for your locality Property characteristics Historical valuation data With this information, the system estimates how much equity your property is worth, and the estimate is available within minutes. The traditional method could take days, but the AI HELOC system gets this done in minutes. Step 4: Income and Cash Flow Review AI HELOC systems evaluate your ability to repay the home equity loan using digital financial signals. The parameters that are evaluated by the system include income consistency, cash flow behavior, deposit history, and overall financial stability. If you connect your bank account securely, this step happens very fast, within 1 hour. This is where many borrowers qualify even if their credit is not perfect, because the system looks at real financial behavior, not just a score. Step 5: Credit Behavior Assessment This step happens instantly. AI HELOC does not assess credit behavior using a single metric. The system reviews payment patterns, credit history, usage trends, recent payment activities, and risk signals (if any are involved). Traditional HELOC would just assess credit scores and reject the application if it finds it not up to the mark. But now, AI allows some borrowers with imperfect credit to get a home equity loan, as long as overall risk remains manageable. As mentioned earlier, this process is instant. This is how fast HELOC is approved for homeowners with bad credit. Step 6: Risk Decision and Credit Limit Calculation Once all the datasets are reviewed, the AI system calculates your approved line of credit limit, determines the HELOC rate, and sets conditions for the loan. This decision-making process is fully automated and happens within minutes. Step 7: Conditional Approval Issued (Within 24 Hours) Now, assuming that everything checks out, your home equity loan is up for approval confirmation. The hardest parts are done, hence the approval takes less than 24 hours. There you have it, HELOC approval with no manual underwriting, no physical visits, and no paperwork. What Happens After the Approval of HELOC? Once the approval is confirmed, a few final steps are necessary to be completed for disbursal. The steps include: Legal disclosures State-specific waiting periods Final account setup These steps depend on where you live and do not slow down the approval itself. Why AI HELOCs Work Even for Challenging Credit Situations If you are wondering why AI HELOCs are the best for borrowers looking for a line of credit, then it’s the ability of AI-powered systems to provide fast HELOC for homeowners, even with bad credit options. This is not at all possible with traditional lenders. Your application would get rejected. Even the rejection would take days when you opt for traditional home equity loans. But AI looks beyond just your credit score and considers parameters that are not the norm in traditional lending. The AI system analyzes factors like your home’s equity position, debt-to-income ratio, payment history & usage trends, and even local market conditions. This holistic analysis means you might qualify for a fast HELOC with bad credit, even if traditional lenders have turned you down. AI HELOC systems level the playing field by identifying compensating factors through public databases and matching them with your credit profile, even if you have a low credit score. For example, if the technology recognizes that your home equity provides strong collateral, it reduces risk for lenders, which is great news to get a line of credit. The speed factor

5 Ways AI HELOCs Outperform Conventional Loans

Home equity is one of the most useful and valuable financial tools available to homeowners. Since home equity gives borrowers access to large amounts of capital, financial institutions or lenders have many protocols in place before approving the loan. This means the service provided is cumbersome, and the process followed is slow. Over time, the way people access HELOCs has changed very little. Some lenders still rely on slow processes, rigid risk models, and outdated approval systems for both conventional home equity loans and traditional HELOCs. But today, AI-powered HELOCs are changing that. The adoption of artificial intelligence cannot be considered a minor upgrade. It distinctly means that the entire system is bound to change forever, same goes for HELOC processing. AI is fundamentally altering how home equity lines of credit are evaluated. AI HELOCs are beginning to outperform conventional loans in practical, measurable ways. Therefore, this article will help you understand and explore the 5 specific ways in which AI HELOCs are outperforming conventional loans. Each section focuses on a clear advantage that directly affects borrowers and lenders. AI HELOCs Assess Risk More Accurately Than Conventional Loans Conventional loans assume risks. The risk assessment policy is static and solely targets the credit options of a borrower. Whether it is a normal mortgage loan or a traditional HELOC, the way risk is calculated is almost the same and quite inefficient. This is a problem for many borrowers. Their financial situations are not static, so why is the risk assessment in conventional loan processing static? The AI HELOCs approach here is different. AI systems continuously analyze multiple data points, including cash flow, behavior, spending & payment patterns, and equity position. Unlike conventional loans that ignore income changes, expense shifts, and changing market conditions, AI systems actively measure them. One of the core benefits of AI HELOC is its ability to narrow the gap between perceived risk and actual risk. When risk is priced more precisely, borrowers are less likely to overpay. This is a fundamental reason AI HELOCs outperform conventional loans, especially for financially stable or improved homeowners. 2. AI HELOCs Adjust Faster to Financial Reality Conventional loans are rigid by design. The terms and conditions are fixed. They do not approve any loans if a borrower’s financial position improves. This rigidity exists because legacy systems do not follow up on credits. There is no continuous reassessment. This is mainly due to manual updating of risk profiles, and reassessments are/were considered unnecessary here in conventional methods. AI HELOCs remove that limitation and reassess profiles continuously. AI systems monitor financial behavior over time, allowing lenders to respond more quickly to changes in borrower stability. This doesn’t mean terms constantly fluctuate, but it does mean decisions are based on current data rather than outdated assumptions. This adaptability represents a major step forward in HELOC innovation because it reflects how people actually manage money rather than how lenders assumed they would decades ago. 3. AI HELOCs Reduce Friction without Reducing Standards One of the major differences between AI HELOCs and conventional loans is efficiency. But speed alone is not the advantage; it is how that is achieved. The process is what defines efficiency, and conventional loans do not have it. Conventional loans rely on sequential processes. It’s a one-step-at-a-time strategy that causes delay and makes borrowers wait for weeks or months. All the delays add up and consume the valuable time of both lenders and borrowers without proper transparency of the progress. AI HELOCs operate differently. Multiple evaluations happen at the same time, including: Property value assessment Income stability analysis Credit behavior evaluation Because these checks run in parallel, approvals move faster without skipping safeguards. And the result is shorter approval timelines, fewer document requests, and less back-and-forth with lenders. This matters because friction often prevents borrowers from using home equity efficiently. By removing unnecessary delays, AI HELOCs allow homeowners to access capital when timing matters. So, efficiency in AI HELOCs is practical, not theoretical. 4. AI HELOCs Handle Non-Traditional Borrowers Better Conventional loans only approve predictable profiles with low or zero risk. Borrowers who have improved their financial situation or who fall outside the norms set by traditional lenders often get rejected or face higher interest rates. These may seem fair, but there are better ways to handle non-traditional borrowers. Self-employed professionals, freelancers and contractors, individuals with variable income, and households with strong cash flow but imperfect credit history are classic examples of non-conventional borrowers. The chances of them getting a line of credit are thin. Mostly because conventional loan underwriters struggle with these profiles. Documents are not the usual type, and no proper pattern of predictability. AI HELOCs evaluate behavior, not just labels. AI systems or models in financial institutions are designed with one thing in mind: the ability to analyze data dynamically. Hence, AI HELOC systems analyze income patterns over time, spending consistency, and repayment behavior of even non-conventional borrowers. AI can identify stability even when documentation is unstable. This finally allows non-traditional borrowers to get fairer evaluations, broader access to home equity, and proper recognition. This is not just a reason why AI HELOC is better than conventional loans; it is a paradigm shift that explains how the process is an important part of the future of home equity loans. Ultimately, AI HELOCs are better suited to changing lending market realities. 5. AI HELOCs Scale Better as Markets Change Evolution is an unchanging, undying process. Processes, techniques, strategies, and operations are bound to evolve. But the real question is, at what rate do they evolve? Conventional loans are slow to evolve. Some of the processes demand delay in traditional ways, such as underwriting rules, pricing models, or approval workflows. These are often under legacy systems and require extensive updates and regulatory reviews to upgrade everything. AI-driven systems are more flexible and scalable. AI HELOC platforms can integrate and incorporate new data sources. They can even adjust models and refine decision logic without having to rebuild the entire system. The

Why AI HELOC Rates Beat Traditional Lenders in 2025

HELOC (Home Equity Lines of Credit) is considered a more flexible lending option compared to direct home loans. It offers borrowers certain advantages, such as interest-only payments, lower interest rates, and need-based borrowing within the line of credit. However, even with lower interest rates, traditional HELOC rates are highly variable. This means that the interest rate can change, potentially making payments unpredictable. For many homeowners and borrowers, the HELOC rates have remained stubbornly high, even when personal finances are strong and home equity is substantial. This is the core issue with traditional lenders. In 2026 and 2027, that dynamic is changing. A growing number of lenders are using artificial intelligence (AI) to price HELOCs more accurately. As a result, AI HELOC rates are increasingly outperforming rates offered by traditional lenders. This is not just because AI is faster and more convenient. It is because AI changes how lending risk is measured, priced, and managed. This article will explore how AI HELOC rates are much better than those of traditional lenders. The Real Problem with Traditional HELOC Rates To understand why AI HELOC rates beat traditional rates and lenders in 2026, it helps to start with the core bottlenecks of traditional lending models. Traditional lending models or the pricing systems for HELOC use static underwriting. This system applies the one-size-fits-all approach. The same rate structure is applied to all customer profiles. This can penalize low-risk borrowers with higher rates than they deserve. Moreover, the borrower’s credit profile is assessed only once with limited data and a set of indicators, such as credit score, reported income, and property value. With this basic information, lenders approve a line of credit and assign a rate that includes a safe margin to tackle variable interest rates tied to the prime rate or LIBOR (London Interbank Offered Rate). Though advantageous to the lenders, this method has severe drawbacks for borrowers who opt for HELOC offers. As a result of choosing traditional lenders: Low-risk borrowers subsidize higher-risk borrowers Strong cash-flow households still pay conservative rates Rate spreads reflect institutional caution, not actual borrower behavior This is why many homeowners feel traditional HELOC pricing is out of sync with their financial reality. Why Traditional Lenders’ Pricing is Conservative by Design The conservative pricing is completely calculative and structural. The HELOC underwriting in traditional lending relies on income verification, manual documentation, and infrequent property valuation updates. However, this is not the reason why pricing is conservative by design. The main reasons why traditional lenders approach HELOC pricing with caution are: Higher operational costs Standard credit score models Variable rates based on external factors Regulatory compliance and risk management Market conditions and economic uncertainty Unstable profitability margins In effect, traditional lenders price for uncertainty. That uncertainty becomes embedded in the rate, even when the borrower’s actual risk profile does not justify it. AI Changes the Foundation of HELOC Pricing Lenders and financial institutions that rely on AI systems for lending approach HELOC rates and pricing from a completely different method. Driven by AI and assessed with precision. Instead of static methods, where credit scores and income are the fundamental eligibility criteria for a line of credit, AI systems assess risk using real-time data. AI does not randomly scan the data. The machine learning algorithm identifies patterns in income flow, spending behavior, asset stability, and local property trends. This is a valuable way to observe how borrowers actually behave throughout the loan repayment process. Therefore, AI is certain in decision-making and optimizes prices and rates. When uncertainty goes down, the need for conservative rate buffers goes down with it. This is the structural reason AI HELOC rates are lower. How Does AI Directly Lower HELOC Rates? The only thing that matters in HELOC for borrowers is the interest rate. Variable interest rates are a hazard for borrowers; AI HELOC rates are considered a more stable option for homeowners. Here’s how AI lowers HELOC rates: More Accurate Income Stability Analysis Underwriting reports are automated, and AI models evaluate the stability of borrowers’ income over time with precision. Real-Time Property Value Confidence Instead of relying on infrequent appraisals, AI systems ingest ongoing market data to assess home equity more accurately. Behavior-Based Risk Modeling AI evaluates how borrowers manage credit in real life, not just how they scored on a report months ago. Continuous Risk Monitoring Traditional HELOC pricing assumes risk is fixed at origination. AI-based models reassess risk throughout the life of the credit line. AI vs Traditional HELOC Rates: The Core Difference When comparing AI vs traditional HELOC rates, the distinction is not speed or convenience. It is the pricing philosophy that matters to the lenders. Traditional lenders: Price for average or worst-case risk Lock in conservative margins upfront for lenders’ safety Adjust slowly, as per fluctuation in external factors like interest rates, economic conditions, or market volatility. AI-driven lenders: Price for individualized risk Shrink margins as certainty increases Adjust based on real borrower behavior This is why AI-driven pricing consistently undercuts traditional HELOC rates for qualified borrowers. Why AI HELOC Rates are an Advantage in 2025 and 2026 Several conditions in the current financial system make AI HELOC rates the perfect solution for borrowers and lenders today. Interest rate sensitivity is high Unlike traditional lenders with fixed rates, AI-driven HELOC rates are better for high interest rate sensitivity because they can dynamically adjust in real-time based on market conditions, borrower risk profiles, and current economic indicators. Economic uncertainty The global economy is constantly fluctuating. Interest rates will remain volatile. However, AI HELOC rates are based on evolving economic conditions, and this creates a more predictable and tailored experience for borrowers. Risk assessment needs Today, the AI models are more mature. Therefore, HELOC rates powered by AI can optimize a broader and more detailed dataset of borrowers for accurate risk predictions. This allows lenders to offer fairer HELOC rates. Demand for personalized rates In 2026, the key advantage of opting for AI in lending is that the HELOC rates can be

Maximize Your Home Equity with Smart Automation

Home equity is a valuable financial resource for homeowners. The system for home equity is brilliantly set up, proving quite helpful for borrowers. Moreover, home equity grows quietly in the background when the borrower’s existing mortgage balance reduces. The more the property value, the better the equity. With such an intricate, yet seamless financial tool, many people find it difficult to use home equity loans when it actually matters. The issues that homeowners face with home equity are its traditional approach, which includes long timelines, repeated checks, and rigid rules. The conventional terms and conditions do not reflect how people actually manage their finances. It is basically an impractical way of assessing borrower eligibility in a dynamic financial reality. This is where the modern fintech advancements have taken over the process and changed it for the better. Therefore, the answer to efficiently accessing home equity lies in smart automation. To use home equity in a more flexible way, lenders are adapting to modern technology, such as AI HELOC and smart automation systems, to evaluate, manage, and update home equity access. This removes outdated barriers and processes, allowing borrowers to access equity as a living financial resource rather than a locked asset. Ultimately, smart automation is becoming an important part of the lending equation. Why Home Equity Is Often Underused The reason why home equity is often left unused is due to traditional systems. The slow and rigid processes make home equity loans a nightmare to access for borrowers. The core issue lies in the static nature of the system. A one-time evaluation locks the financial capacity of borrowers, which doesn’t allow them to get a reevaluation of their financial situation even after they improve; the original assumption stays in place. The traditional approach is the greatest demerit of home equity, leaving a significant amount unused. Financial institutions relying on this approach fail to understand their borrower’s evolving needs, and it’s time for that to change. Smart automation introduces a different way of thinking. The approach is dynamic evaluation. Instead of relying on a single evaluation, automated systems allow lenders to consider ongoing financial signals. Smart automation draws out patterns from a borrower’s income, repayment behavior, and changes in property value. This way, the results are not the same as before, and decisions feel more aligned with real life rather than fixed rules from the past. How Smart Automation Changes Home Equity Access Smart automation changes the evaluation strategy for home equity. When it comes to the traditional approach, borrowers have to go through new paperwork or long approval cycles for even basic changes in the evaluation. This often discourages homeowners from using equity thoughtfully over time. As a result, most homeowners avoid opting for home equity. Smart HELOC automation removes this level of rigidity and saves time for both lenders and borrowers. In smart automation approaches, the updates happen in the background. This way, all the borrowers’ latest data are adjusted as per their latest financial circumstances. Homeowners no longer need to restart the process or fill in tons of paperwork. Accessing equity has never been easier. Smart HELOC automation enables a smoother, more responsive, and better-suited approach to assessing borrowers’ financial health. The difference between traditional HELOCs and AI HELOCs is clearly visible with measurable results. Instead of treating home equity as a one-time borrowing solution, automation allows it to function as an ongoing financial tool, as it is meant to be. Using an AI HELOC Strategy to Maximize Home Equity Maximizing home equity does not mean borrowing as much as possible. It means using home equity at the right time and for the right purpose effectively and efficiently. This modern approach is only possible through smart automation. Using AI HELOC systems is the best way to maximize home equity. There are no delays or traditional restrictions. Hence, homeowners are less likely to turn to higher-cost alternatives like credit cards or actual loans. AI HELOC systems adjust naturally to financial changes, enabling borrowers to use smaller amounts intentionally, without worrying about being locked into static credit assessments. This is the practical value of smart HELOC automation. It allows homeowners to integrate equity into their financial planning instead of treating it as a last-resort option. Why Smart Automation Works Better for Modern Financial Situations Modern income patterns are not always predictable. Individuals with variable incomes would struggle with traditional lending models. As explained earlier, traditional HELOC requires uniform documentation and steady monthly figures. Automated systems are better suited to these realities. Instead of focusing on a single credit metric, AI HELOCs or smart automation look at patterns and consistency over time. This allows for fairer evaluations that reflect how people actually earn and manage money. This means homeowners can access home equity that previously felt out of reach, even when their financial behavior improved over time. The Role of Automation in the Future of Home Equity Loans Housing markets change. Interest rates move. Financial behavior evolves. Systems that rely on fixed processes struggle to keep up. Smart automation allows home equity products to adapt more easily to changing conditions. Updated data can be incorporated more quickly, and decisions can better reflect current realities rather than outdated assumptions. This flexibility benefits homeowners and lenders alike. This adaptability is why smart automation is becoming central to the future of home equity loans. It creates products that feel more relevant, more responsive, and more practical. Making Home Equity Easier to Use Without Complexity No one likes a complex task. Hence, automation gives clarity. Simple processes lead to better understanding and ultimately help in decision-making. The overall home equity process is faster with automation. Moreover, AI HELOCs are more transparent, allowing borrowers to understand their loan status even better and encouraging them to use more of their equity. Conclusion Financial institutions are looking for better fintech solutions to help their customers. Borrowers or homeowners, on the other hand, may not be aware of the modern technologies that have taken over this landscape. Especially

How AI HELOCs Skip Traditional Mortgage Hassles

HELOC (Home Equity Lines of Credit) is a flexible lending option that allows homeowners to borrow funds based on their equity. HELOC is not a mortgage, and it does not replace the existing borrowers’ mortgages. It is important to understand the distinction between HELOCs and mortgages. Yet for years, borrowers have found that applying for a HELOC is similar to applying for a mortgage. HELOCs are not mortgages. But somehow the HELOC process does indeed often mimic the traditional mortgage application process, and that is an issue. This means that traditional lenders have made the HELOC process resemble mortgage underwriting. In pursuit of approval, borrowers overlook this, resulting in delays, manual paperwork, and friction that were never necessary in the first place. To bypass the traditional mortgage-style hassles in HELOC processes, AI is key. AI-driven HELOCs are changing the process or redefining the way it’s supposed to be by removing unnecessary steps while keeping core lending checks intact. This article explains, step by step, how AI HELOCs eliminate traditional mortgage-style hassles. Why HELOCs Resemble Mortgage-Style Friction Lines of credit are a completely different lending model in comparison with mortgages. However, for years now, a similar infrastructure or working model has been used for both mortgages and HELOCs. Over time, some financial institutions have started adopting long-term mortgage loan workflows for HELOC approvals. These workflows typically include: Full property appraisals Manual income documentation Underwriting reviews & verification Conservative, static risk assessments Extended approval timelines These steps were never required for HELOC approvals; however, they have become the norm. This traditional approach has made HELOC, a variation of the mortgage process, and it carries similar hassles. AI HELOC removes this inherited friction or hassles by redesigning the approval process from the ground up. Let’s find out how! The Traditional Mortgage Hassles in HELOC When borrowers, homeowners, and applicants complain about HELOC being a mortgage-like experience, they are usually referring to specific process issues. So, the most common traditional mortgage hassles in HELOC include: Property appraisals Document-heavy income verification Delays in underwriting decisions Receiving unclear or delayed status updates Responding to last-minute conditions But the great news is that AI HELOCs address these exact pain points by replacing manual checks with data-driven analysis. Hassle #1: Property Appraisals To confirm property value, most lenders would require a physical or drive-by appraisal. This is a manual process, and it introduces delays and scheduling issues. Even when the geographical market data is available, the process moves slowly. How AI HELOCs skip appraisals: AI HELOC platforms evaluate the housing market by leveraging real-time data and automating valuation models to assess the appraisals. The systems analyze recent comparable sales, neighborhood trends, historical pricing, and property records to estimate value accurately. AI HELOC completely removes the need for an in-person appraisal. This is exactly why many borrowers encounter AI HELOC no appraisal options, or skip HELOC appraisal requirements. With this, there are no more appraisal appointments, no fees in many cases, and faster movement for credit approval. Hassle #2: Document-Heavy Income Verification In traditional mortgage processes, borrowers need to submit documents such as pay stubs, tax returns, bank statements, and credit reports, among many others. If the approval time is extended, there might be an error with the documentation process, and lenders would ask to resubmit it entirely. How AI HELOCs reduce paperwork: AI systems in lending are basically designed to analyze financial patterns. Machine learning does not rely on static documents; instead, it understands the dynamic financial behavior of a borrower. Secure digital connections allow systems to assess the necessary information from the borrowers’ profiles. This way, documentation is no longer a burden for both lenders and borrowers. This is a major contributor to the hassle-free HELOC experience. Hassle #3: Sequential Underwriting Delays Underwriting is a multistage, tedious process that involves several teams. One team reviews income, another takes care of property value, and the next checks credit and verification. Borrowers have to wait through the entire process and be anxious to know the decision. How AI HELOCs work here: AI systems are not just automation tools; they are multitasking systems that complete multiple tasks at the same time or in a matter of seconds. Income stability, equity position, credit behavior, and market data are assessed simultaneously rather than sequentially. This eliminates handovers, delays, and additional resource usage, leading to faster decision-making. Moreover, with AI HELOC, borrowers gain quicker eligibility feedback, faster approvals, and fewer stalled applications. Hassle #4: Unclear Status and Last-Minute Conditions Transparency is not a core aspect of traditional mortgage processes. Borrowers often have to wait days, weeks, or even months to understand the status of their application. And when they do receive an update, it’s often not what they expect due to last-minute changes in conditions that may require re-application. How AI HELOCs improve transparency here: AI-powered lending platforms provide clearer status updates, explaining the cause for the decision made. Since risk is evaluated continuously, potential issues are flagged sooner. This way, borrowers can understand their home equity credit status in a more predictable, clearer, and transparent way, avoiding any last-minute surprises. Therefore AI HELOC process reduces stress and uncertainty throughout the application. The Bigger Picture: How AI HELOCs Skip Mortgage-Style Hassles HELOCs were never meant to mirror mortgages in complexity. However, AI-powered HELOC bypasses or even eliminates many traditional hurdles typically found in mortgage processes. So, here’s how AI HELOCs skip traditional mortgage hassles and make the journey smoother for both lenders and homeowners: Instant Decision-Making Real-time assessment of borrower applications using machine learning algorithms helps lenders to make an informed decision. Automated Risk Assessment AI can analyze borrowers’ risk profiles instantly. It compares patterns from a large pool of data. This eliminates guesswork, human judgment, and outdated scoring methods. Personalized HELOC offers Borrowers can choose from customized loan terms. AI generates personalized HELOC offers based on an individual’s financial behavior. Reduced Paperwork This is where the manual workforce is cut off. With AI-powered HELOC systems in place, financial institutions can automate,

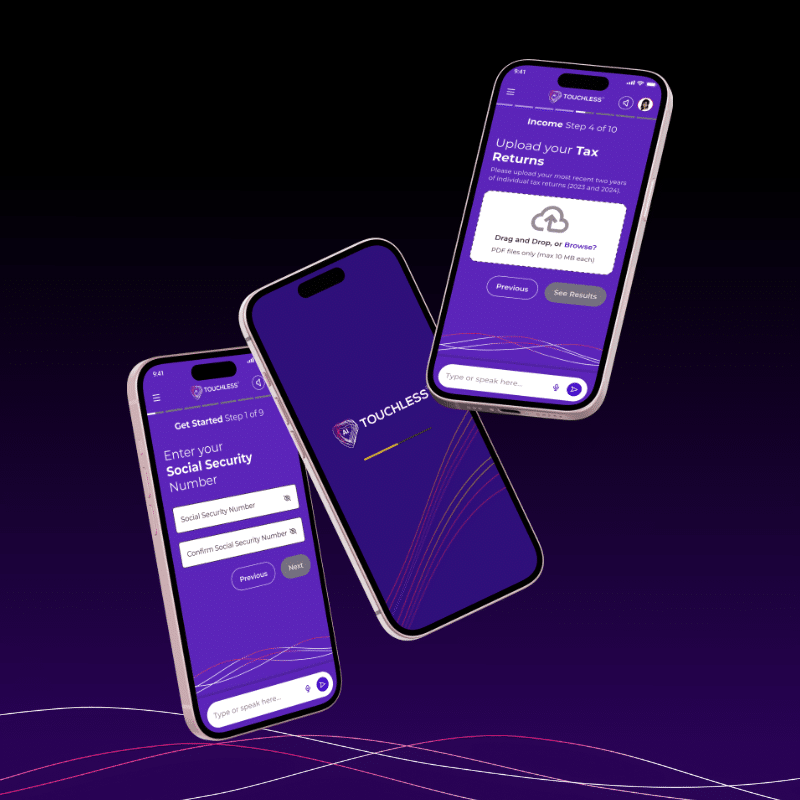

Tavant Launches Transformative TOUCHLESS® AI Mortgage Origination Suite

LAS VEGAS, Oct. 20, 2025—Tavant, a leading provider of AI-powered fintech solutions and digital engineering, announced today the release of its industry-leading TOUCHLESS® AI Mortgage Origination Suite. This AI and Agentic AI-powered suite enables end-to-end AI transformation of mortgage origination from lead to funded loan, improving borrower experience, driving up lead conversion, reducing origination cost, and compressing cycle times. It provides a full suite of modules to upgrade existing LOS and POS using Agentic AI Assistants, AI-powered Document Analysis, AI-assisted Underwriting, and an Agentic AI architecture that dynamically personalizes workflows and loan products and programs. “TOUCHLESS® now allows any lender to rapidly transition into the era of AI,” said Mohammad Rashid, Head of TOUCHLESS® at Tavant. “The industry’s promise of seamless borrower experience and lower origination cost has often fallen short. The TOUCHLESS® AI suite allows lenders to rapidly wrap their LOS and POS to unlock higher borrower satisfaction, increased loan volumes, and dramatically lower origination costs. It’s time for the industry to truly move forward and bring the full power of AI to borrowers and employees.” A core innovation of TOUCHLESS® is MAYA™, an intelligent AI assistant that provides personalized, real-time support and feedback throughout the entire application process for borrowers, loan officers, and underwriters. MAYA™ hand-holds borrowers through complicated questions, steps in when they hesitate, and guides applications to submission, increasing conversion rates. It helps borrowers clear conditions, vastly improving the borrower experience. MAYA™ explains nuances in mortgage products and programs and responds 24/7 to leads from digital sources, boosting conversion at key moments of truth across the origination chain. It also increases underwriter productivity when paired with TOUCHLESS® AI-powered document analysis, data consistency checks, automated conditions clearing, and Policy-as-Code underwriting, enabling underwriters to decision a loan in the most efficient way. “With the introduction of our Intelligent AI Assistant MAYA™, TOUCHLESS® is redefining the mortgage origination experience,” continued Rashid. “MAYA™ is human-like and can address any questions and concerns borrowers have and deliver real-time personalized guidance throughout the application process, helping them navigate each step with clarity and confidence. This reduces application errors and abandonment rates, accelerates loan processing, and empowers borrowers and lenders alike with seamless, hyper-personalized support—ultimately saving time and lowering costs for everyone involved.” Pilot implementations with top-tier mortgage originators have shown the transformative impact of TOUCHLESS® AI, boosting underwriter productivity by a factor of twelve, slashing overall operational costs by 60%, and reducing the time to close loans to just a matter of days. Tavant’s TOUCHLESS® AI Mortgage Origination Suite, featuring the AI Assistant MAYA™, AI-powered Intelligent Document Analysis, AI-assisted Underwriting, and the Agentic AI Architecture, will be showcased at this year’s Mortgage Bankers Association Annual Convention in Las Vegas, Nevada, from October 20-22. During this session, the attendees can experience a live, on-stage demonstration highlighting TOUCHLESS® capabilities to super-power mortgage origination through AI. About TOUCHLESS® TOUCHLESS® is the industry-leading, AI-powered suite of software modules allowing any mortgage lender to rapidly transition into the era of AI. Through its core components, MAYA™ – the AI Assistant, AI-Powered Document Analysis, AI-Assisted Underwriting, Agentic AI Architecture, and AI-Driven Executive BI, TOUCHLESS® allows lenders to rapidly wrap their LOS and POS to unlock higher borrower satisfaction, increased loan volumes, and dramatically lower origination costs. Through built-in interoperability with all incumbent LOS and connectivity to more than 200 data, title, and appraisal providers in the mortgage industry, TOUCHLESS® allows lenders to take automation through AI to entirely new levels. TOUCHLESS® super-powers mortgage origination through AI.