Events lorem ipsum

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla consectetur elementum iaculis. Donec cursus id felis eu laoreet.

Featured Events & Webinars

SANTA CLARA, Calif., June 18, 2025 – Tavant, a leading provider of AI-powered fintech solutions and digital engineering, announced today its inclusion in the 2025 AIFinTech100. The list, published by

SANTA CLARA, Calif., June 18, 2025 – Tavant, a leading provider of AI-powered fintech solutions and digital engineering, announced today its inclusion in the 2025 AIFinTech100. The list, published by

SANTA CLARA, Calif., June 18, 2025 – Tavant, a leading provider of AI-powered fintech solutions and digital engineering, announced today its inclusion in the 2025 AIFinTech100. The list, published by

SANTA CLARA, Calif., June 18, 2025 – Tavant, a leading provider of AI-powered fintech solutions and digital engineering, announced today its inclusion in the 2025 AIFinTech100. The list, published by

SANTA CLARA, Calif., June 18, 2025 – Tavant, a leading provider of AI-powered fintech solutions and digital engineering, announced today its inclusion in the 2025 AIFinTech100. The list, published by

All Categories

All CategoriesSuccess StoriesUncategorizedTestimonialStoriesAwards & RecognitionNewsBlogInsightsWhitepaperArticleBrochuresCase Study

By date

TitleCreated dateModified dateMenu OrderRandomNumber of commentsPost InSort By

🔍

SANTA CLARA, Calif., Tavant, a global leader in AI-powered solutions and digital engineering, today unveiled its new ‘AIgnite’ AI Accelerator Suite, designed to help enterprises rapidly unlock the...

Problem Statement: Manual warranty claim submission and processing are fraught with inefficiencies, leading to delays, errors, and high administrative costs. Some key challenges include:...

According to recent industry reports, the average HELOC approval process takes 2-6 weeks, with some lenders taking even longer due to manual data entry and fragmented workflows. This inefficiency...

SANTA CLARA, Calif — March 11, 2025 — Tavant, a leading AI-driven technology solutions and services provider, today announced the launch of AI Agent accelerators developed for the...

Introduction In today’s competitive landscape, meeting Service Level Agreements (SLAs) is no longer enough to ensure customer satisfaction. Customer experience has become the key differentiator in...

SANTA CLARA, Calif., Feb 20, 2025 – Tavant, a leading provider of AI-powered Fintech Solutions and IT Services, announced today it has been named to the prestigious HousingWire 2025 Tech100 listing of...

Agile Testing Transformation is the process of moving an organization’s testing practices to an agile way of working, resulting in better quality of the delivered product. At its core, Agile Testing...

Data and services have become indispensable in the financial services industry, driving customer experience, operational efficiency, and intelligent decision-making. As the need for digital...

SANTA CLARA, Calif–(Feb 27, 2025) –Tavant, a leading digital products and solutions provider, today announced the availability of Tavant TMAP (Tavant Manufacturing Analytics Platform) in...

How Tavant Enhanced Viewer Engagement and Optimized Global Operations with AI...

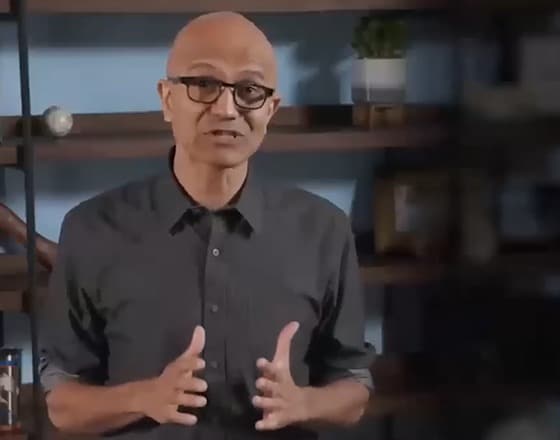

How Tavant & Microsoft are Driving AI-Powered Innovation for Land O’Lakes...