Data and services have become indispensable in the financial services industry, driving customer experience, operational efficiency, and intelligent decision-making. As the need for digital transformation grows, smart data and partner integrations are redefining the relationship between borrowers and lenders.

At the heart of the transformation, intelligent data integration is a revolutionizing internal process. At Tavant, we understand the importance of intelligent data integration solutions, and FinConnect is the answer to simplify your lending experiences with vendors and best-in-class customer experiences. Let’s delve into the current trends, challenges, and solutions of financial transformation driven by intelligent data integration in this thought leadership article.

The Role of Intelligent Data Integration

Financial institutions are turning to intelligent data integration to streamline their operations and deliver better experiences for customers. Let’s see how Tavant has come up with the data integration solutions with FinConnect:

- Real-time Analytics and Predictive Insights – Connected platforms enable financial institutions to monitor transactions and customer behavior in real-time. This capability improves agility and responsiveness. By integrating data analytics, organizations can forecast market trends, optimize portfolio performance, and anticipate emerging risks, thus staying ahead of the curve.

- Automation of Repetitive Tasks – By leveraging artificial intelligence (AI), financial services can automate all the time-consuming tasks such as fraud detection, compliance checks, and risk assessment. FinConnect processes mortgage-related data for automatic routine operations which allows organizations to focus on higher-value tasks.

- Improved Data Accuracy and Operational Scalability – Intelligent systems clean and verify the data, reducing manual errors and ensuring high-quality information. It is crucial to maintain the integrity of financial services, designed to scale, handle, and adapt to changing demands without compromising performance.

Enhancing Customer Experience with Intelligent Data

Let us understand how to enhance the customer experience using intelligent data and how FinConnect is using data integration solutions:

- Personalized Loan Options and Faster Approvals – Lenders can access customized loan products through connected data platforms. These platforms offer products tailored to the unique financial situations of borrowers. Traditional and non-traditional data sources (such as utility payments and rental history) provide lenders with creditworthiness.

- Enhanced Transparency and Seamless User Experience – Transparency and clear communication are what borrowers expect today throughout the lending process. You get real-time updates in the connected data platforms. Platforms like FinConnect eliminate paper documentation, automate document submissions, and provide intuitive interfaces, improving the user experience.

- Building Long-Term Relationships with the Vendors – Tavant views its vendor relationships as long-term partnerships rather than transactional collaborations, fostering mutual trust, improving communication, and enhancing the overall quality of service delivered to financial institutions. In turn, this long-term approach allows Tavant to continuously improve its offerings suitable for changing market conditions and customer demands.

How does FinConnect Serving Data Integration Solutions?

Tavant is shaping the financial transformation with the invention of platforms like FinConnect. Let’s understand some of the aspects of how it enhances the lending experience for lenders and borrowers:

- The Power of API Integrations in Modern Lending

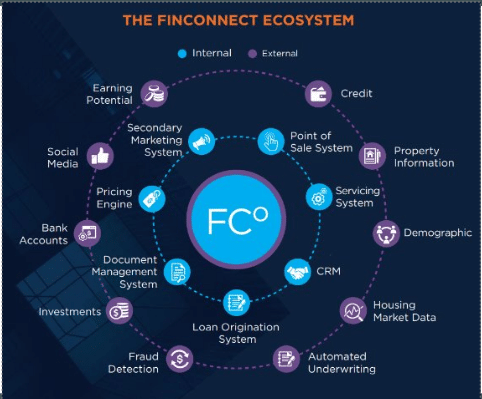

Application Programming Interfaces (API) create a connecting bridge between diverse systems and stakeholders. FinConnect integrates with more than 100 partners and vendors through APIs, acting as a one-stop solution for all things mortgages.

FinConnect streamlines the data exchange systems driven by APIs. It facilitates faster underwriting, improves risk assessments, and enhances fraud detection. The product not only connects financial institutions to third-party services like credit scoring, compliance checks, and data verification, ensuring a smooth digital transformation. Let’s understand the ecology of FinConnect in the following diagram:

- Plug-and-Play Financial Services: Simplifying Lending Solution with FinConnect

The introduction of “plug-and-play” is transforming the arena of financial services. It is a game changer for both borrowers and lenders. With platforms like FinConnect, you don’t need any technical overhauls to integrate new services, vendors, and data sources. This flexibility of the platform reduces inefficiencies and allows organizations to meet market demands quickly.

Borrowers can enjoy faster access to credit by seamlessly utilizing the plug-and-play system. It is more transparent which increases operational efficiency and reduces the time-to-time market for new products and services.

- On-demand Data: Streamlining Lending Processes

The availability of on-demand data from both sources and third-party vendors is beneficial for lenders as they get access to more accurate, creditworthiness, and timely insights into borrower behavior and market conditions. FinConnect adheres to the compliance and data verification tools and allows lenders to access real-time, accurate data, improves decision-making speed and reduces delays.

With the help of on-demand data, streaming data analytics is easier and the outcome is faster. FinConnect integrates with ComplianceEase to ensure data governance and loan verification process, which makes it seamless for lenders.

- Ensuring Security and Speed in Loan Processing

FinConnect securely ensures loan processing is done quickly. With the increased reliance on digital platforms, FinConnect provides robust security measures including end-to-end encryption. Tavant adheres to the following security measures:

- CCPA (California Consumer Privacy Act): For users located in California, Tavant follows CCPA regulations, giving them control over their personal information, including the right to know what data is collected and the right to delete or opt out of the sale of personal data.

- PCI DSS (Payment Card Industry Data Security Standard): For financial transactions, Tavant ensures that payment data is processed and stored in compliance with PCI DSS standards, minimizing the risk of fraud and data breaches.

The Future of Digital Transformation with FinConnect by Tavant

FinConnect by Tavant is leading the financial services landscape through intelligent data integration. Leveraging real-time analytics and enabling automation, it streamlines the lending experience. FinConnect not only modernizes lending but also fosters a more inclusive, transparent, and customer-centric financial ecosystem. Tavant, for instance, is leading the charge in digital transformation for the financial services industry. By combining real-time analytics, automation, and a powerful API ecosystem, FinConnect is empowering institutions to stay competitive and deliver exceptional customer experiences. Ready to transform your lending operations? Connect with us to see how FinConnect can help your institution thrive in the digital age.

Contacts

Swapna Karakavalasa

+1-866-9-TAVANT

[email protected]