Reimagine Lending with Touchless Lending® LO.ai

Discover how Tavant’s next-generation AI loan officer revolutionizes digital lending with intelligent automation and zero human touch.

Reimagine Lending with Touchless Lending® LO.ai

Discover how Tavant’s next-generation AI loan officer revolutionizes digital lending with intelligent automation and zero human touch.

From Manual to Magical—Transforming Lending with AI

The lending ecosystem is evolving—yet many institutions remain stuck in outdated processes. Manual interventions, compliance complexity, and fragmented systems delay decision-making and limit scale.

Transition:

With LO.ai, Tavant introduces the Loan Officer AI assistant built to enable fast loans AI workflows—driving speed, compliance, and borrower satisfaction across the lifecycle.

Bussiness use cases

Manual Loan Origination

Problem: Time-consuming, paper-based processes drain productivity and delay approvals.

Solution: Our intelligent loan automation platform simplifies origination using AI-powered loan processing and rule-based workflows.

Stat: Reduce origination time by 60% with automated workflows powered by AI lending solutions.

Processing Delays

Problem: Underwriting and document verification often create operational bottlenecks.

Solution: With AI lending automation, Tavant enables real-time data extraction, document recognition, and instant decision-making.

Customer Experience

Problem: Legacy systems lead to inconsistent borrower interactions and disengagement.

Solution: Our seamless lending solutions use digital mortgage interfaces to enhance personalization, speed, and transparency.

Stat: Boost borrower satisfaction by 45% with our digital mortgage solutions and AI mortgage automation.

Risk & Compliance Management

Problem: Keeping up with evolving regulations adds complexity and increases the chance of manual errors.

Solution: LO.ai ensures end-to-end compliance by leveraging AI-driven rule engines that audit, validate, and report in real-time—enabling the future of loan officers to be proactive, not reactive.

Loan Officer Productivity

Problem: Traditional workflows overwhelm loan officers with repetitive tasks and documentation.

Solution: Tavant’s LO.ai acts as an AI loan officer and assistant—automating everyday tasks, surfacing insights, and freeing time to focus on strategic borrower relationships.

Stat: Increase loan officer capacity by up to 3x using our Loan officer AI assistant built for fast loans AI processing.

- Manual Loan Origination

- Processing Delays

- Customer Experience

- Risk & Compliance Management

- Loan Officer Productivity

Manual Loan Origination

Problem: Time-consuming, paper-based processes drain productivity and delay approvals.

Solution: Our intelligent loan automation platform simplifies origination using AI-powered loan processing and rule-based workflows.

Stat: Reduce origination time by 60% with automated workflows powered by AI lending solutions.

Processing Delays

Problem: Underwriting and document verification often create operational bottlenecks.

Solution: With AI lending automation, Tavant enables real-time data extraction, document recognition, and instant decision-making.

Customer Experience

Problem: Legacy systems lead to inconsistent borrower interactions and disengagement.

Solution: Our seamless lending solutions use digital mortgage interfaces to enhance personalization, speed, and transparency.

Stat: Boost borrower satisfaction by 45% with our digital mortgage solutions and AI mortgage automation.

Risk & Compliance Management

Problem: Keeping up with evolving regulations adds complexity and increases the chance of manual errors.

Solution: LO.ai ensures end-to-end compliance by leveraging AI-driven rule engines that audit, validate, and report in real-time—enabling the future of loan officers to be proactive, not reactive.

Loan Officer Productivity

Problem: Traditional workflows overwhelm loan officers with repetitive tasks and documentation.

Solution: Tavant’s LO.ai acts as an AI loan officer and assistant—automating everyday tasks, surfacing insights, and freeing time to focus on strategic borrower relationships.

Stat: Increase loan officer capacity by up to 3x using our Loan officer AI assistant built for fast loans AI processing.

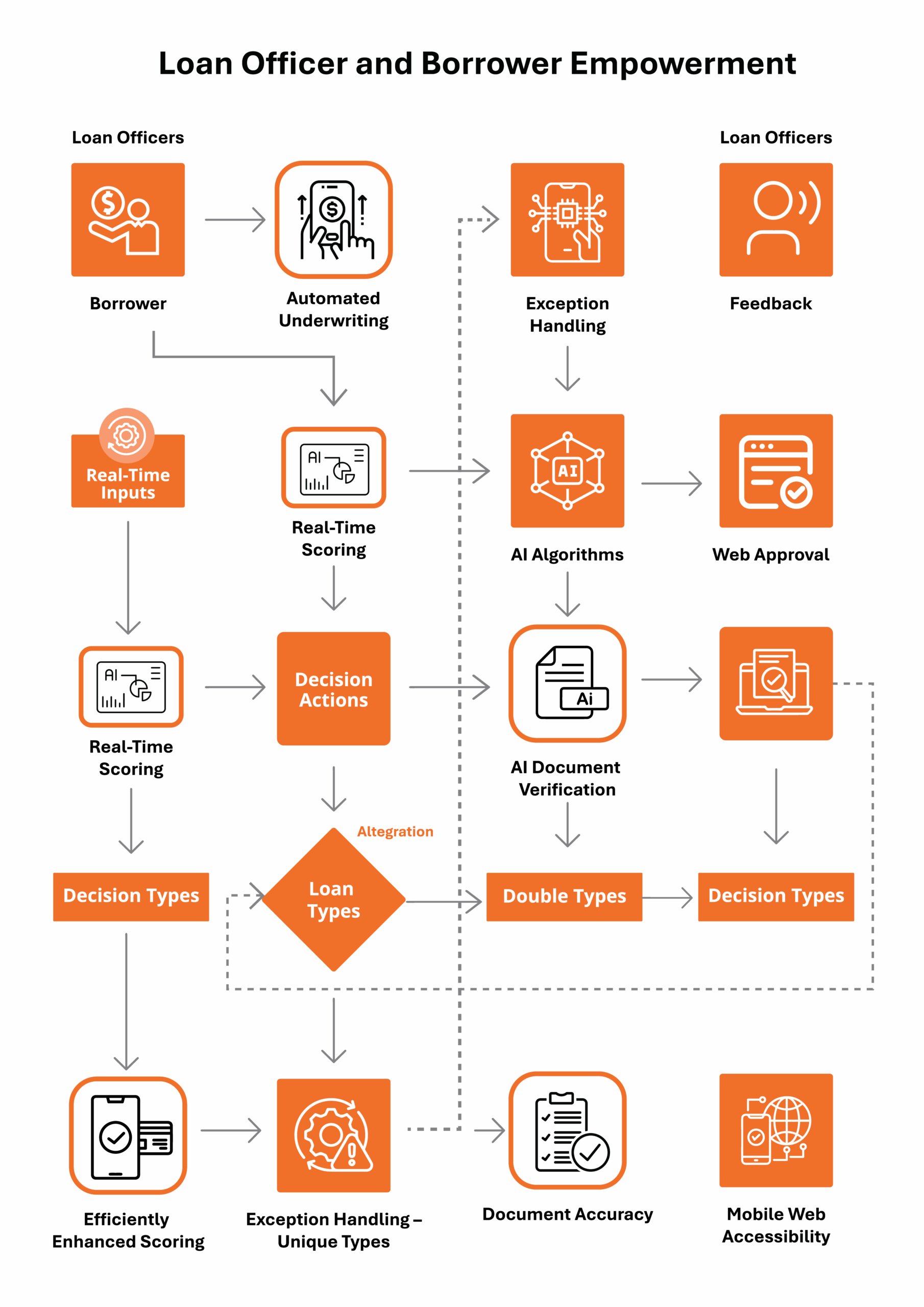

How Touchless Lending Flows from Start to Finish